Social Security Benefits vs Income

bitcoin is garbage?

P. That's why he says bitcoin won't exist in 20 years.

A. I wouldn’t dare to predict when the supply of foolish people will run out. I would not know how to put a date for its end, but it will come. It can’t go on like this forever, because it depends on more people putting money in than taking it out. That will never change.

Seven Considerations for Retirement

Dave Barry’s Year in Revew: 2021

Beat Inflation

FP Software

Instead of entering just one value for the whole retirement period, break it into 2 or three values, entering each one as a separate Other Expense cash flow with a given start and end year.

So rather than viewing the output of the tool as a prediction of what will happen, it’s best to view it as support for making short term decisions about what to do over the next few years. Use the tool to guide these decisions, but revisit them often and reevaluate them in light of any new information you have.'

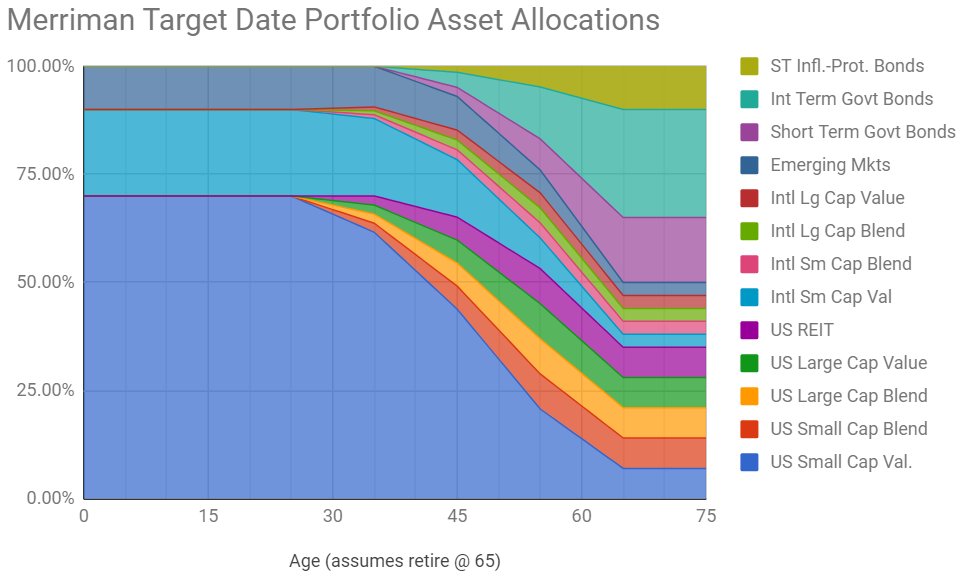

Build Your Own Target Date Investment Portfolio